Home Office Deduction Hoa . If you use part of your home exclusively and regularly for conducting business, you may be. Home office deduction at a glance. Similarly, if you use your property for a small business, such as a home office or rental business, you may be able to deduct hoa fees. If you purchase property as your primary residence and you are required to pay monthly, quarterly or yearly hoa fees, you cannot deduct. To deduct expenses for business use of the home, you must use part of your home as one of the following: Homeowners who use a portion of their home exclusively for business purposes may qualify.

from db-excel.com

To deduct expenses for business use of the home, you must use part of your home as one of the following: Homeowners who use a portion of their home exclusively for business purposes may qualify. Home office deduction at a glance. If you use part of your home exclusively and regularly for conducting business, you may be. Similarly, if you use your property for a small business, such as a home office or rental business, you may be able to deduct hoa fees. If you purchase property as your primary residence and you are required to pay monthly, quarterly or yearly hoa fees, you cannot deduct.

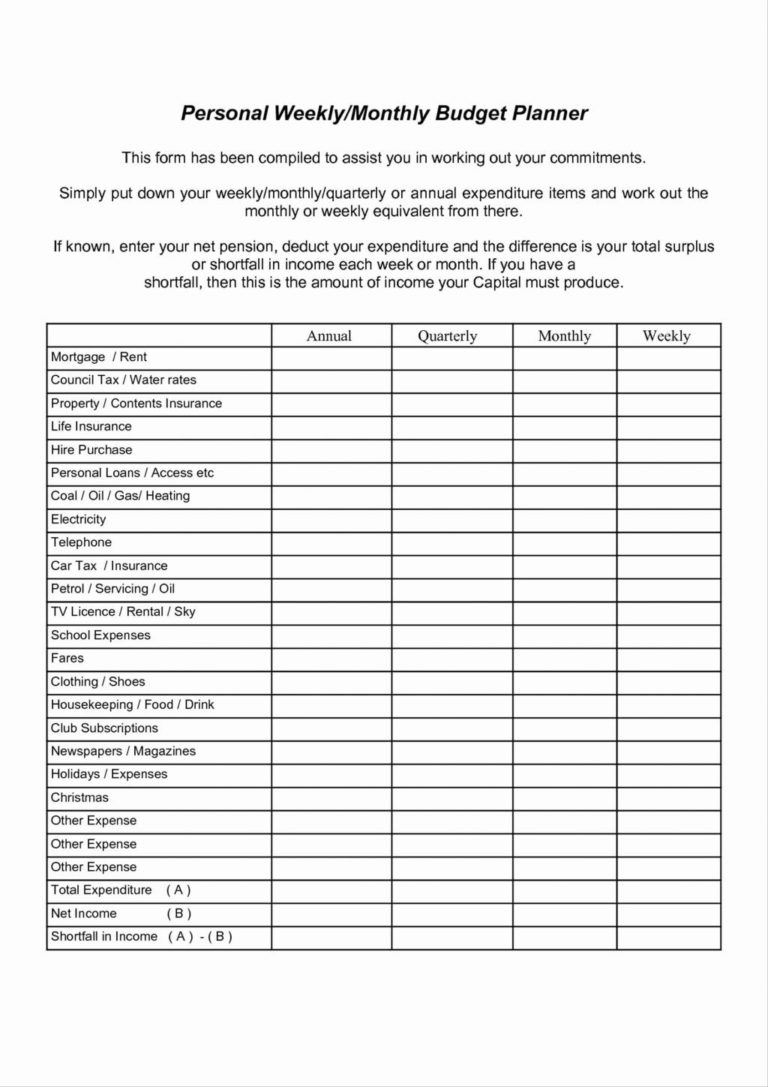

Hoa Budget Spreadsheet pertaining to Hoa Accounting Spreadsheet Sheet

Home Office Deduction Hoa Homeowners who use a portion of their home exclusively for business purposes may qualify. Similarly, if you use your property for a small business, such as a home office or rental business, you may be able to deduct hoa fees. If you use part of your home exclusively and regularly for conducting business, you may be. Homeowners who use a portion of their home exclusively for business purposes may qualify. If you purchase property as your primary residence and you are required to pay monthly, quarterly or yearly hoa fees, you cannot deduct. To deduct expenses for business use of the home, you must use part of your home as one of the following: Home office deduction at a glance.

From davida.davivienda.com

Home Office Deduction Worksheet Excel Printable Word Searches Home Office Deduction Hoa If you use part of your home exclusively and regularly for conducting business, you may be. Similarly, if you use your property for a small business, such as a home office or rental business, you may be able to deduct hoa fees. To deduct expenses for business use of the home, you must use part of your home as one. Home Office Deduction Hoa.

From onlinemlmcommunity.com

The Home Office Deduction 15 Things You Should Know Online MLM Community Home Office Deduction Hoa If you use part of your home exclusively and regularly for conducting business, you may be. Home office deduction at a glance. Homeowners who use a portion of their home exclusively for business purposes may qualify. If you purchase property as your primary residence and you are required to pay monthly, quarterly or yearly hoa fees, you cannot deduct. Similarly,. Home Office Deduction Hoa.

From shunshelter.com

Understanding How To Include Hoa Fees In Your Home Office Deduction Home Office Deduction Hoa Homeowners who use a portion of their home exclusively for business purposes may qualify. To deduct expenses for business use of the home, you must use part of your home as one of the following: If you use part of your home exclusively and regularly for conducting business, you may be. Similarly, if you use your property for a small. Home Office Deduction Hoa.

From www.stkittsvilla.com

Can You Take A Home Office Tax Deduction Virblife Com Home Office Deduction Hoa If you use part of your home exclusively and regularly for conducting business, you may be. If you purchase property as your primary residence and you are required to pay monthly, quarterly or yearly hoa fees, you cannot deduct. Home office deduction at a glance. To deduct expenses for business use of the home, you must use part of your. Home Office Deduction Hoa.

From benchmark.us

Tax Tips for Homeowners Claiming a Home Office Deduction Benchmark Home Office Deduction Hoa If you purchase property as your primary residence and you are required to pay monthly, quarterly or yearly hoa fees, you cannot deduct. Homeowners who use a portion of their home exclusively for business purposes may qualify. Similarly, if you use your property for a small business, such as a home office or rental business, you may be able to. Home Office Deduction Hoa.

From www.youtube.com

Can You Deduct Homeowners Association Fees On Your Taxes Home Office Deduction Hoa To deduct expenses for business use of the home, you must use part of your home as one of the following: Homeowners who use a portion of their home exclusively for business purposes may qualify. Similarly, if you use your property for a small business, such as a home office or rental business, you may be able to deduct hoa. Home Office Deduction Hoa.

From pruscpa.com

Home Office Deduction Walkthrough By GP CPA, Accountant In NC Home Office Deduction Hoa To deduct expenses for business use of the home, you must use part of your home as one of the following: If you purchase property as your primary residence and you are required to pay monthly, quarterly or yearly hoa fees, you cannot deduct. If you use part of your home exclusively and regularly for conducting business, you may be.. Home Office Deduction Hoa.

From www.exceptionaltaxservices.com

Save Big Time On Taxes How To Do Your Home Office Deduction Right Home Office Deduction Hoa If you purchase property as your primary residence and you are required to pay monthly, quarterly or yearly hoa fees, you cannot deduct. If you use part of your home exclusively and regularly for conducting business, you may be. Home office deduction at a glance. Similarly, if you use your property for a small business, such as a home office. Home Office Deduction Hoa.

From www.patriotsoftware.com

Home Office Tax Deduction Deduction for Working from Home Home Office Deduction Hoa Similarly, if you use your property for a small business, such as a home office or rental business, you may be able to deduct hoa fees. If you use part of your home exclusively and regularly for conducting business, you may be. To deduct expenses for business use of the home, you must use part of your home as one. Home Office Deduction Hoa.

From www.pinterest.com

Work from home? Choose from two methods of home office deduction Home Office Deduction Hoa If you use part of your home exclusively and regularly for conducting business, you may be. To deduct expenses for business use of the home, you must use part of your home as one of the following: Home office deduction at a glance. Homeowners who use a portion of their home exclusively for business purposes may qualify. Similarly, if you. Home Office Deduction Hoa.

From www.everycrsreport.com

The Home Office Tax Deduction Home Office Deduction Hoa Homeowners who use a portion of their home exclusively for business purposes may qualify. Similarly, if you use your property for a small business, such as a home office or rental business, you may be able to deduct hoa fees. If you use part of your home exclusively and regularly for conducting business, you may be. If you purchase property. Home Office Deduction Hoa.

From www.taxuni.com

Home Office Deduction Calculator 2024 Home Office Deduction Hoa Similarly, if you use your property for a small business, such as a home office or rental business, you may be able to deduct hoa fees. To deduct expenses for business use of the home, you must use part of your home as one of the following: Home office deduction at a glance. Homeowners who use a portion of their. Home Office Deduction Hoa.

From www.youtube.com

Business Use of Your Home Tax Deduction Home Office Deduction YouTube Home Office Deduction Hoa If you purchase property as your primary residence and you are required to pay monthly, quarterly or yearly hoa fees, you cannot deduct. Home office deduction at a glance. If you use part of your home exclusively and regularly for conducting business, you may be. Homeowners who use a portion of their home exclusively for business purposes may qualify. To. Home Office Deduction Hoa.

From jackiewarren375headline.blogspot.com

Jackie Warren Headline Home Office Expenses Deduction 2022 Home Office Deduction Hoa If you use part of your home exclusively and regularly for conducting business, you may be. Homeowners who use a portion of their home exclusively for business purposes may qualify. Similarly, if you use your property for a small business, such as a home office or rental business, you may be able to deduct hoa fees. To deduct expenses for. Home Office Deduction Hoa.

From worksheets.decoomo.com

30++ Home Office Deduction Worksheet Worksheets Decoomo Home Office Deduction Hoa If you use part of your home exclusively and regularly for conducting business, you may be. Homeowners who use a portion of their home exclusively for business purposes may qualify. Home office deduction at a glance. Similarly, if you use your property for a small business, such as a home office or rental business, you may be able to deduct. Home Office Deduction Hoa.

From cjdfintech.com

Maximize Your Savings Unraveling the Benefits of the Home Office Tax Home Office Deduction Hoa Similarly, if you use your property for a small business, such as a home office or rental business, you may be able to deduct hoa fees. Homeowners who use a portion of their home exclusively for business purposes may qualify. To deduct expenses for business use of the home, you must use part of your home as one of the. Home Office Deduction Hoa.

From db-excel.com

Hoa Budget Spreadsheet pertaining to Hoa Accounting Spreadsheet Sheet Home Office Deduction Hoa Homeowners who use a portion of their home exclusively for business purposes may qualify. To deduct expenses for business use of the home, you must use part of your home as one of the following: If you use part of your home exclusively and regularly for conducting business, you may be. If you purchase property as your primary residence and. Home Office Deduction Hoa.

From wesuregroup.com

Home Office Tax Deduction Tips for Small Business Owners Home Office Deduction Hoa Homeowners who use a portion of their home exclusively for business purposes may qualify. If you use part of your home exclusively and regularly for conducting business, you may be. To deduct expenses for business use of the home, you must use part of your home as one of the following: If you purchase property as your primary residence and. Home Office Deduction Hoa.